In the recent past we have heard that Brexit will cause: Sterling to crash by 20% (1), Banks to move to EU (2), Banks on both sides of Atlantic to be struck down by uncertainty (3), London to lose its status as financial capital (4) etc.

These were all rumours put out by US banking giant Goldman Sachs. (Check the links provided above if you dont believe it). This American bank is one of the main, if not principal financers of the "Britain Stronger in Europe Campaign". In fact they, along with the European Movement, started the remain campaign. Yes, Britain Stronger in Europe was started by and financed by an American investment bank.

Goldman Sachs is particularly famous in the UK because it, and the other big US, "Stronger In" backer, JP Morgan, precipitated Gordon Brown's give away of UK gold between 1999 and 2002. Apparently no-one knows why Brown rescued these US Banks with British taxpayer's money (but there is a full explanation in Note 1 below). We do know that Tony Blair retired into a £2m pa Directorship with JP Morgan which also involved huge consultancy fees (See Tony Blair biopic).

Why is a US investment bank so desperate to influence British politics? To understand this we need to understand that Goldman Sachs does not appear to be an upright company. In fact in America the bank is openly derided in the strongest terms:

Goldman Sachs: "a great vampire squid wrapped around the face of humanity" (Rolling Stone Magazine).

Yet those voting "Remain" in the EU Referendum believe and support those financed by this monster. Strong words? Read on:

"The bank's unprecedented reach and power have enabled it to turn all of America into a giant pump-and-dump scam, manipulating whole economic sectors for years at a time, moving the dice game as this or that market collapses, and all the time gorging itself on the unseen costs that are breaking families everywhere.." The Great American Bubble Machine

Goldman Sachs was one of the worst offenders in the financial crisis and was investigated for deliberately creating packages of bad debt that it then sold on at a profit. Goldman Sachs was also implicated in the beginnings of the Greek financial collapse, using a similar process of creating billions of dollars of bad debt which it resold for a profit.

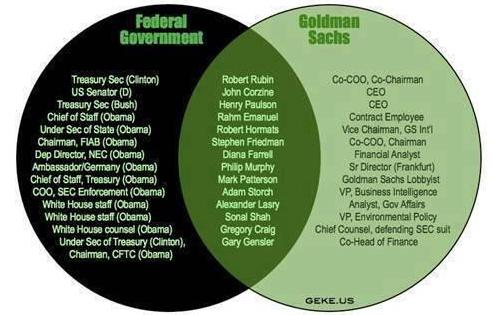

In the USA they know Goldman Sachs and revile it. It is said that its most vicious trait is the way it launches senior staff into government allegedly as payback for financing election campaigns:

Goldman Sachs Alumni get everywhere and it pays off, for instance Henry Paulson (a Goldman Sachs man) launched the US bank bailout and one of its greatest beneficiaries was Goldman Sachs:

The most prominent Goldman Sachs alumnus in the UK is Mark Carney, Governor of the Bank of England. He is the first non-UK citizen to run the Bank of England. As well as the Governor of the Bank of England, his deputy Ben Broadbent, is ex Goldman Sachs, as were two previous Monetary Policy Committee members, David Walton and Sushil Wadhwani (See Mark Carney, Governor of the Bank of Goldman Sachs)..

Goldman Sachs are now getting the contracts for selling off government assets such as RBS. The Government has let Goldman Sachs off its UK taxes through a special dispensation by HMRC.

It would be interesting to know what George Osborne and the Tories are getting in return for these favours to Goldman Sachs. In the USA Goldman Sachs openly fund politicians with large sums. In the UK the funding is less obvious. The Conservatives are particularly fond of fund raising dinners and balls. As an example a member of the Cameron's Leader's Group pays £50,000 and gets dinner. Christopher French, Head of European Investment Banking, attended in 2015 for Goldman Sachs who send someone most years. A list of these relatively small donors is given here. The Tories get their most significant donations from bankers and hedge funds (See bank rolling the Tories). However, the really big funding seems to come from loans that are never repaid. Loans from abroad did not need to be declared and there is evidence of loans from Goldman Sachs alumni such as £1m in 2006 and £2.5m in 2005 from Mr Hintze:

"Mr Hintze, a former trader at investment bank Goldman Sachs, has dual Australian and British nationality and is reported to have funnelled his loan through an offshore trust based in Jersey." (Sky News)

However, this method of bribing the Tories has now been shut down and we don't really know how they are getting the big money today. One would suspect some scam involving Goldman Sachs.

Goldman Sachs is exceptional because it really does seem to be corrupt on the grand scale and lying is its modus operandi:

"Goldman Sachs CEO Lloyd Blankfein should be hung by his thumbs in a public square... Because the climate he oversees at Goldman is completely void of common morals and ethics. This bunch of bloodsuckers would sell out their own mother if it meant they could put a couple bucks in their pocket." How Corrupt is Goldman Sachs?

"The Federal Bureau of Investigation and the U.S. Department of Justice are examining Goldman Sachs Group Inc's role in allegations of corruption and money laundering at Malaysian state investor 1Malaysia Development Bhd (1MDB), the Wall Street Journal reported on Wednesday." Reuters This involves a $700m dollar bribe taken by the Prime Minister of Malaysia.

It is probable that Goldman Sachs' "influence" was responsible for the failure of the US Federal Reserve to act until the Financial Crisis was well under way. Bloomberg.

Nowhere is immune: "What finally broke her government was the deal to sell a large stake in Dong Energy to Goldman Sachs, while giving them veto rights over management decisions. The deal was opposed by 68% of the Danish public, and it brought out thousands of protesters." Daily Kos: Goldman Sachs brings down another European Government

Yet the British media treat foreign funding of "Stronger In" as if it were perfectly natural and make no mention of the fact that the Investment Bank that is paying the piper is a corporate renegade that almost counts as a criminal organisation. The media presentation of the EU has been so successful that there are middle aged, middle class ladies who think the EU is some sort of social project! It would be funny if it wasn't so....

See also: How the EU was born its shocking, involves the CIA and subversion of whole populations!

17/3/16

Note 1: Why the UK sold its gold:

From the Telegraph:

"One decision stands out as downright bizarre, however: the sale of the majority of Britain’s gold reserves for prices between $256 and $296 an ounce, only to watch it soar so far as $1,615 per ounce today.

When Brown decided to dispose of almost 400 tonnes of gold between 1999 and 2002, he did two distinctly odd things.

First, he broke with convention and announced the sale well in advance, giving the market notice that it was shortly to be flooded and forcing down the spot price. This was apparently done in the interests of “open government”, but had the effect of sending the spot price of gold to a 20-year low, as implied by basic supply and demand theory.

Second, the Treasury elected to sell its gold via auction. Again, this broke with the standard model. The price of gold was usually determined at a morning and afternoon “fix” between representatives of big banks whose network of smaller bank clients and private orders allowed them to determine the exact price at which demand met with supply.

The auction system again frequently achieved a lower price than the equivalent fix price. The first auction saw an auction price of $10c less per ounce than was achieved at the morning fix. It also acted to depress the price of the afternoon fix which fell by nearly $4.

It seemed almost as if the Treasury was trying to achieve the lowest price possible for the public’s gold. It was. …

This plan worked brilliantly when gold fell and the other asset – for the bank at the heart of this case, yen-backed securities – rose. When the prices moved the other way, the banks were in trouble.

This is what had happened on an enormous scale by early 1999. One globally significant US bank in particular is understood to have been heavily short on two tonnes of gold, enough to call into question its solvency if redemption occurred at the prevailing price.

Goldman Sachs, which is not understood to have been significantly short on gold itself, is rumoured to have approached the Treasury to explain the situation through its then head of commodities Gavyn Davies, later chairman of the BBC and married to Sue Nye who ran Brown’s private office.

Faced with the prospect of a global collapse in the banking system, the Chancellor took the decision to bail out the banks by dumping Britain’s gold, forcing the price down and allowing the banks to buy back gold at a profit, thus meeting their borrowing obligations."

These were all rumours put out by US banking giant Goldman Sachs. (Check the links provided above if you dont believe it). This American bank is one of the main, if not principal financers of the "Britain Stronger in Europe Campaign". In fact they, along with the European Movement, started the remain campaign. Yes, Britain Stronger in Europe was started by and financed by an American investment bank.

Goldman Sachs is particularly famous in the UK because it, and the other big US, "Stronger In" backer, JP Morgan, precipitated Gordon Brown's give away of UK gold between 1999 and 2002. Apparently no-one knows why Brown rescued these US Banks with British taxpayer's money (but there is a full explanation in Note 1 below). We do know that Tony Blair retired into a £2m pa Directorship with JP Morgan which also involved huge consultancy fees (See Tony Blair biopic).

Why is a US investment bank so desperate to influence British politics? To understand this we need to understand that Goldman Sachs does not appear to be an upright company. In fact in America the bank is openly derided in the strongest terms:

Goldman Sachs: "a great vampire squid wrapped around the face of humanity" (Rolling Stone Magazine).

Yet those voting "Remain" in the EU Referendum believe and support those financed by this monster. Strong words? Read on:

"The bank's unprecedented reach and power have enabled it to turn all of America into a giant pump-and-dump scam, manipulating whole economic sectors for years at a time, moving the dice game as this or that market collapses, and all the time gorging itself on the unseen costs that are breaking families everywhere.." The Great American Bubble Machine

Goldman Sachs was one of the worst offenders in the financial crisis and was investigated for deliberately creating packages of bad debt that it then sold on at a profit. Goldman Sachs was also implicated in the beginnings of the Greek financial collapse, using a similar process of creating billions of dollars of bad debt which it resold for a profit.

In the USA they know Goldman Sachs and revile it. It is said that its most vicious trait is the way it launches senior staff into government allegedly as payback for financing election campaigns:

|

| From: Can the UK Escape the Clutches of Goldman Sachs |

The most prominent Goldman Sachs alumnus in the UK is Mark Carney, Governor of the Bank of England. He is the first non-UK citizen to run the Bank of England. As well as the Governor of the Bank of England, his deputy Ben Broadbent, is ex Goldman Sachs, as were two previous Monetary Policy Committee members, David Walton and Sushil Wadhwani (See Mark Carney, Governor of the Bank of Goldman Sachs)..

Goldman Sachs are now getting the contracts for selling off government assets such as RBS. The Government has let Goldman Sachs off its UK taxes through a special dispensation by HMRC.

It would be interesting to know what George Osborne and the Tories are getting in return for these favours to Goldman Sachs. In the USA Goldman Sachs openly fund politicians with large sums. In the UK the funding is less obvious. The Conservatives are particularly fond of fund raising dinners and balls. As an example a member of the Cameron's Leader's Group pays £50,000 and gets dinner. Christopher French, Head of European Investment Banking, attended in 2015 for Goldman Sachs who send someone most years. A list of these relatively small donors is given here. The Tories get their most significant donations from bankers and hedge funds (See bank rolling the Tories). However, the really big funding seems to come from loans that are never repaid. Loans from abroad did not need to be declared and there is evidence of loans from Goldman Sachs alumni such as £1m in 2006 and £2.5m in 2005 from Mr Hintze:

"Mr Hintze, a former trader at investment bank Goldman Sachs, has dual Australian and British nationality and is reported to have funnelled his loan through an offshore trust based in Jersey." (Sky News)

However, this method of bribing the Tories has now been shut down and we don't really know how they are getting the big money today. One would suspect some scam involving Goldman Sachs.

Goldman Sachs is exceptional because it really does seem to be corrupt on the grand scale and lying is its modus operandi:

"Goldman Sachs CEO Lloyd Blankfein should be hung by his thumbs in a public square... Because the climate he oversees at Goldman is completely void of common morals and ethics. This bunch of bloodsuckers would sell out their own mother if it meant they could put a couple bucks in their pocket." How Corrupt is Goldman Sachs?

"The Federal Bureau of Investigation and the U.S. Department of Justice are examining Goldman Sachs Group Inc's role in allegations of corruption and money laundering at Malaysian state investor 1Malaysia Development Bhd (1MDB), the Wall Street Journal reported on Wednesday." Reuters This involves a $700m dollar bribe taken by the Prime Minister of Malaysia.

It is probable that Goldman Sachs' "influence" was responsible for the failure of the US Federal Reserve to act until the Financial Crisis was well under way. Bloomberg.

Nowhere is immune: "What finally broke her government was the deal to sell a large stake in Dong Energy to Goldman Sachs, while giving them veto rights over management decisions. The deal was opposed by 68% of the Danish public, and it brought out thousands of protesters." Daily Kos: Goldman Sachs brings down another European Government

Yet the British media treat foreign funding of "Stronger In" as if it were perfectly natural and make no mention of the fact that the Investment Bank that is paying the piper is a corporate renegade that almost counts as a criminal organisation. The media presentation of the EU has been so successful that there are middle aged, middle class ladies who think the EU is some sort of social project! It would be funny if it wasn't so....

See also: How the EU was born its shocking, involves the CIA and subversion of whole populations!

17/3/16

Note 1: Why the UK sold its gold:

From the Telegraph:

"One decision stands out as downright bizarre, however: the sale of the majority of Britain’s gold reserves for prices between $256 and $296 an ounce, only to watch it soar so far as $1,615 per ounce today.

When Brown decided to dispose of almost 400 tonnes of gold between 1999 and 2002, he did two distinctly odd things.

First, he broke with convention and announced the sale well in advance, giving the market notice that it was shortly to be flooded and forcing down the spot price. This was apparently done in the interests of “open government”, but had the effect of sending the spot price of gold to a 20-year low, as implied by basic supply and demand theory.

Second, the Treasury elected to sell its gold via auction. Again, this broke with the standard model. The price of gold was usually determined at a morning and afternoon “fix” between representatives of big banks whose network of smaller bank clients and private orders allowed them to determine the exact price at which demand met with supply.

The auction system again frequently achieved a lower price than the equivalent fix price. The first auction saw an auction price of $10c less per ounce than was achieved at the morning fix. It also acted to depress the price of the afternoon fix which fell by nearly $4.

It seemed almost as if the Treasury was trying to achieve the lowest price possible for the public’s gold. It was. …

This plan worked brilliantly when gold fell and the other asset – for the bank at the heart of this case, yen-backed securities – rose. When the prices moved the other way, the banks were in trouble.

This is what had happened on an enormous scale by early 1999. One globally significant US bank in particular is understood to have been heavily short on two tonnes of gold, enough to call into question its solvency if redemption occurred at the prevailing price.

Goldman Sachs, which is not understood to have been significantly short on gold itself, is rumoured to have approached the Treasury to explain the situation through its then head of commodities Gavyn Davies, later chairman of the BBC and married to Sue Nye who ran Brown’s private office.

Faced with the prospect of a global collapse in the banking system, the Chancellor took the decision to bail out the banks by dumping Britain’s gold, forcing the price down and allowing the banks to buy back gold at a profit, thus meeting their borrowing obligations."

Comments