Mark Carney's Reith Lectures are fascinating not only because they are analysing recent history but because they are providing a deep insight into the minds of bankers. Carney comes across as a decent man, he probably is a decent man. I have worked with some of the best salesmen in the world and was initially shocked to discover that most were really decent people who had a deep interest in their fellow human beings. The nature of Mark Carney will always be a mystery to most of us.

In his second Reith lecture Carney implies that the financial crisis was not predicted by any policymakers who mattered, that it was a moral failing and that the crisis was only fixed because of global cooperation. He is creating a set of myths, most probably to salve the consciences of bankers and restore their reputations.

(What is written below is mild compared with the official US Government report into the financial crisis.)

The financial crisis was predicted. In 2007 the major popular publications in economics had article after article on the coming crash. (See Could the credit crunch have been foreseen? ). The crash was blindingly obvious and only the exact date was in doubt. If policymakers failed to notice what was coming it was their negligence at fault.

The huge effect of the financial crisis was due to the sheer volume of subprime (ie: dubious) debt. Most of this debt was acquired in the mortgage market.

This dubious debt was packaged up into mixed bags of debt called "Collateralised Debt Obligations" (CDOs). These packages of mixed debt were rated by credit rating agencies and sold or used as collateral on the banking markets. When the US housing market declined the CDOs became high risk or valueless and ceased to work as assets to back the loans that had been based on their asset value. Were CDOs a "moral" failing or a criminal enterprise? The editors of Wikipedia have summarised the criminal nature of what happened:

|

| A Banker |

The credit ratings were basically subjective and hence the pressure to add another "A" grade, and hence million dollars, to a Collateral Debt Obligation was impossible to resist. What happened had a criminal nature but the regulations banning it had been removed. That said, the law against fraud should have been applied after the crisis and the colluding bankers and credit raters shipped off to Alcatraz for 30 years.

Carney's converting of criminal behaviour into moral failing is a whitewash job.

The idea that the crisis was only fixed because of global cooperation is disingenuous in the extreme. Regulations had been put in place after the 1930s to reduce the global intertwining of national financial systems so that the 1930s would never happen again. These laws worked until the late 1980s when they were systematically dismantled under pressure from the large investment banks. Within 10 years the financial system had gone global so that a decline in house prices in the USA could affect the cost of a loan in Cairo. This is what the Financial Crisis Inquiry Commission concluded:

"In the early part of the 20th century, we erected a series of protections – the Federal Reserve as a lender of last resort, federal deposit insurance, ample regulations – to provide a bulwark against the panics that had regularly plagued America's banking system in the 19th century. Yet, over the past 30-plus years, we permitted the growth of a shadow banking system – opaque and laden with short term debt – that rivaled the size of the traditional banking system. Key components of the market – for example, the multi trillion-dollar repo lending market, off-balance-sheet entities, and the use of over-the-counter derivatives – were hidden from view, without the protections we had constructed to prevent financial meltdowns. We had a 21st-century financial system with 19th-century safeguards."

Undoubtedly the crisis required international cooperation once it had happened but it only happened because of excessive international cooperation. The regulations are supposed to cauterize failures to small parts of the system but by the turn of the 20th century they had lapsed and dubious assets in the USA were being used to back loans in Kuwait. The system was primed for international contagion.

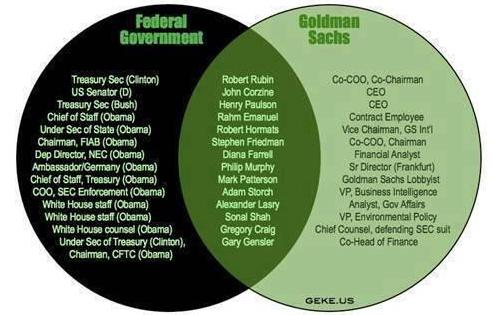

Each point of Mark Carney's lecture has been used to portray bankers as poor souls who fell from grace but who can be contrite and recover their reputations. The truth is that a greedy cabal of international Investment Banks stole $15 trillion dollars from the people of the world and even to this day have not been brought to account. The failure to prosecute these people means that they are setting up the global system for another collapse. Worse still, they now know that their planting of alumni in government has worked, it has saved them from prosecution so they believe they are invulnerable.

The chart below shows how Goldman Sachs alumni have been powerful players in the US government. Goldman Sachs and other investment bank employees continue to infest government posts in the UK as well as the USA.

|

| Goldman Sachs Alumni in the US Government. |

Also see: Mark Carney's First Reith Lecture

and THE FINANCIAL CRISIS INQUIRY REPORT Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States.

9/12/2020

Comments