The broadcast media has suppressed coverage of the actual trade figures during the UK-EU Brexit negotiations. Here is the important data with links (in blue) that you can click to see the original sources to check for yourselves.

How important is UK-EU Trade?

The figures above are for both Goods and Services Exports. See Exports of Goods and Services to EU28 (L84Y), Exports of Goods and Services Total (ikbh)

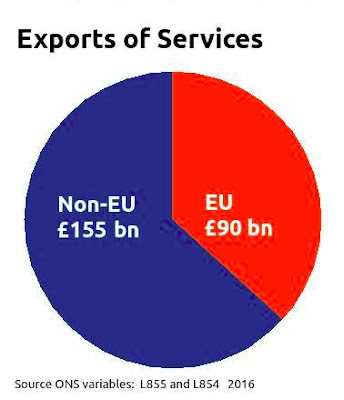

Only 36% of service exports go to the EU. See Exports of Services - non-EU28 (L855) and Exports of Services - EU28 (L854)

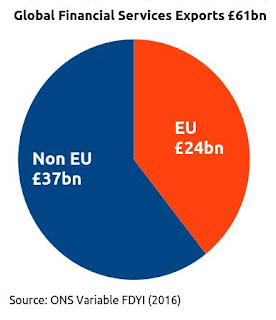

Most of these exports of services (c.75%) are consultancy, media etc. The proportion that are financial services, £61 bn, are to be found in Financial Services Exports (FDYI). The proportion of these going to the EU is very difficult to discover, it is estimated that 40%, c. £24bn, go to the EU. This is a very small amount compared with the UK economy. The coverage of Financial Services in the media gives the false impression that it is the largest part of UK exports.

Financial services are a small part of global services exports and financial services exports to the EU are only 40% of that small part.

What does the UK export and import?

We are always told that food exports will attract high tariffs if the UK leaves the EU without a deal. How important are food exports? Food and non-alcoholic drink exports to the EU of £10bn are a very small proportion of all UK exports (c.£550bn).

The most important factor when considering the WTO option for the UK economy is that the UK has a surprisingly varied portfolio of exports:

See Top 20 Exports by SITC.

Even the largest item, cars, is only 9.3% of the total UK export volume. According to the Society of Motor Manufacturers and Traders about 50% of car exports go to the EU by number. If this equates to value then car exports to the EU are worth about £19 bn over the year, again, a surprisingly small proportion of the highly diversified UK export portfolio. It should also be remembered that 75% or more of cars such as the Vauxhalls produced at Ellesmere Port are constructed from foreign components (often EU made) so the £19 bn of apparent car exports to the EU is nearer £5bn when imported parts are included in the calculation.

We hear a great deal about Food, Cars and Financial Services in the context of UK-EU trade but all three of these combined are about £53 bn which is only 9.6% of all UK exports. The UK export trade is highly diversified and hence robust. (See The City needs the EU like a Fish needs a Bicycle for an in-depth discussion of Financial Services exports to EU).

Tariffs

The UK is a member of the World Trade Organisation in its own right, as well as being a member of the EU group in the WTO. Countries trading with the EU on "WTO Terms" (known quaintly as Most Favoured Nation Status) will pay the following tariffs on exports:

Source: WTO

According to the Civitas analysis the UK will pay £5.2 billion in tariffs on goods being sold to the EU. However, EU exporters will also face £12.9 billion in tariffs on goods coming to the UK. In the UK the car industry would have the highest tariff bill of £1.3 billion per annum.

As can be seen, the tariffs payable by the EU are higher than those payable by the UK. This should lead to considerable substitution of UK goods for EU goods in the UK economy, so ameliorating the deficits to be described below. In the long run such substitution of domestic for foreign produce seems to be the rule rather than the exception and this results in GDP growth being decoupled from tariffs.

This lack of relationship between tariffs and growth should give the UK confidence in the No Deal scenario for Brexit.

How well is the UK doing trading with the EU?

The UK is developing a "Regional" economy within the EU with investment from mainland Europe that enables mainland businesses to use their mainland warehouses etc to supply the UK operation with stock, staff and other resources. The UK is becoming a region of the EU as Cornwall is a region of the UK. EU investment in the UK is like a London company setting up a branch in Newquay - the investment comes from London and all the goods used by the branch are made in London, most of the employees will be in London and when the branch is sold it will probably be bought by another SE company, Cornwall will have been marginalised with the branch being a way of syphoning funds out of the SW. This pattern of regionalising behaviour is now happening between the EU and UK.

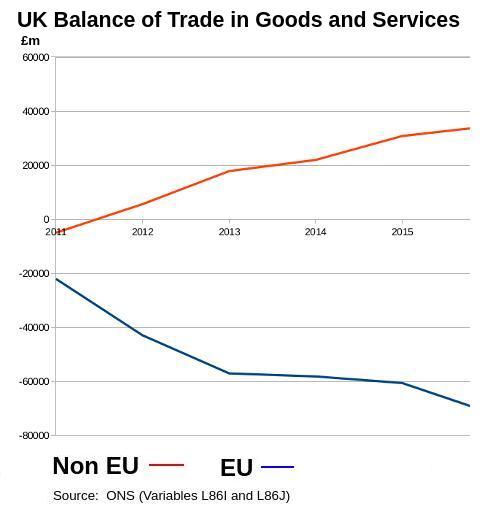

The balance of trade figures highlight the way that trade with the EU is different from trade with the rest of the world. UK exporters do well in both markets but EU importers are especially favoured because EU companies can freely import their own stock and equipment into the UK.

See ONS data at:

How important is UK-EU Trade?

Only 36% of service exports go to the EU. See Exports of Services - non-EU28 (L855) and Exports of Services - EU28 (L854)

Most of these exports of services (c.75%) are consultancy, media etc. The proportion that are financial services, £61 bn, are to be found in Financial Services Exports (FDYI). The proportion of these going to the EU is very difficult to discover, it is estimated that 40%, c. £24bn, go to the EU. This is a very small amount compared with the UK economy. The coverage of Financial Services in the media gives the false impression that it is the largest part of UK exports.

Financial services are a small part of global services exports and financial services exports to the EU are only 40% of that small part.

What does the UK export and import?

We are always told that food exports will attract high tariffs if the UK leaves the EU without a deal. How important are food exports? Food and non-alcoholic drink exports to the EU of £10bn are a very small proportion of all UK exports (c.£550bn).

The most important factor when considering the WTO option for the UK economy is that the UK has a surprisingly varied portfolio of exports:

See Top 20 Exports by SITC.

Even the largest item, cars, is only 9.3% of the total UK export volume. According to the Society of Motor Manufacturers and Traders about 50% of car exports go to the EU by number. If this equates to value then car exports to the EU are worth about £19 bn over the year, again, a surprisingly small proportion of the highly diversified UK export portfolio. It should also be remembered that 75% or more of cars such as the Vauxhalls produced at Ellesmere Port are constructed from foreign components (often EU made) so the £19 bn of apparent car exports to the EU is nearer £5bn when imported parts are included in the calculation.

We hear a great deal about Food, Cars and Financial Services in the context of UK-EU trade but all three of these combined are about £53 bn which is only 9.6% of all UK exports. The UK export trade is highly diversified and hence robust. (See The City needs the EU like a Fish needs a Bicycle for an in-depth discussion of Financial Services exports to EU).

Tariffs

The UK is a member of the World Trade Organisation in its own right, as well as being a member of the EU group in the WTO. Countries trading with the EU on "WTO Terms" (known quaintly as Most Favoured Nation Status) will pay the following tariffs on exports:

Source: WTO

According to the Civitas analysis the UK will pay £5.2 billion in tariffs on goods being sold to the EU. However, EU exporters will also face £12.9 billion in tariffs on goods coming to the UK. In the UK the car industry would have the highest tariff bill of £1.3 billion per annum.

|

| Civitas Data |

As can be seen, the tariffs payable by the EU are higher than those payable by the UK. This should lead to considerable substitution of UK goods for EU goods in the UK economy, so ameliorating the deficits to be described below. In the long run such substitution of domestic for foreign produce seems to be the rule rather than the exception and this results in GDP growth being decoupled from tariffs.

|

| Trade Policy and Economic Growth: A Skeptic's Guide to the Cross-National Evidence |

This lack of relationship between tariffs and growth should give the UK confidence in the No Deal scenario for Brexit.

How well is the UK doing trading with the EU?

The UK is developing a "Regional" economy within the EU with investment from mainland Europe that enables mainland businesses to use their mainland warehouses etc to supply the UK operation with stock, staff and other resources. The UK is becoming a region of the EU as Cornwall is a region of the UK. EU investment in the UK is like a London company setting up a branch in Newquay - the investment comes from London and all the goods used by the branch are made in London, most of the employees will be in London and when the branch is sold it will probably be bought by another SE company, Cornwall will have been marginalised with the branch being a way of syphoning funds out of the SW. This pattern of regionalising behaviour is now happening between the EU and UK.

The balance of trade figures highlight the way that trade with the EU is different from trade with the rest of the world. UK exporters do well in both markets but EU importers are especially favoured because EU companies can freely import their own stock and equipment into the UK.

|

| UK-EU Trade Balance to December 2016 |

See ONS data at:

This regionalising behaviour, where EU businesses from Renault-Nissan through Vauxhall-Opel and EDF and Lidl, act as trojan horses for imports of parts and stock and shunt wealth into the Eurozone from UK.

The large deficits in trade and investment income with the EU have created a huge Balance of Payments Deficit of £115 bn per annum.

Most of which comes from the large deficits in trade and investment income with the EU

… a reduction in the current account deficit from its current record [peacetime] levels will be important for any government wishing to claim that the UK is making a balanced and sustainable economic recovery.” See Parliamentary Reportto confirm this.

Adherents of the Twin Deficit Theory in economics will have spotted that the huge trade deficit may be causing Austerity in the UK.

In the long run, currencies decline in the face of persistent Current Account Deficits: " A persistent current account deficit could lead to a sudden adjustment in capital flows or depreciation of the exchange rate, with adverse consequences for UK financial stability." Bank of England

Which is, of course, precisely what has happened:

The detailed figures for imports and exports for 2016 are as follows:

Imports of goods and services, non-EU (L865) £272457m

Exports of goods and services, non-EU (L84Z) £311635 m

Balance of trade, non-EU +£39178 m

Imports of goods and services EU28 (L864) £318029 m

Exports of goods and services EU28 (L84Y) £235838 m

Balance of trade EU - £82191 m

The imbalance of trade with the EU directly lowers UK GDP by 4% (Exports-Imports are used to calculate GDP).

Aviation

Claims that leaving the EU could result in the grounding of all flights from the UK to the EU are simply nonsense, aviation is regulated by the International Civil Aviation Organisation.

See The Imbalance of UK-EU Trade and its consequences

How far do Foreign Owned/ Foreign Affiliated Companies Distort the Balance of Trade?

The UK Office of National Statistics does not maintain data on the value of imports due to Foreign Companies operating in the UK. The available data shows that in 2015 30% of foreign owned businesses in the UK were exporters of goods and 42.3% were importers of goods but it does not provide any estimate of the value of goods involved. Importers can appear very good for the economy because their "Gross Value Added" data - the profit made on imported goods - can be very high compared with the costs of staff, raw materials etc introduced into the product costs within the UK. As a result foreign owned companies appear to be highly successful, accounting for about 25% of Gross Value Added in the UK economy. (See Gross value added by foreign owned businesses and UK foreign direct investment (total investment), table 3.1). Productivity also looks surprisingly healthy in companies that sell foreign made, or largely foreign made goods although, of course, this is just an artefact of the fact that the British subsidiary did not actually make the goods..

Why UK statistical services do not provide data on the import bill due to Foreign Investment is a mystery. Data for New Zealand shows that Foreign Affiliates are responsible for over half the value of New Zealand's imports but only provided 25% of its exports of goods.

In the absence of official data for the value of imports and exports due to foreign owned companies we can point to the huge trade imbalance between the UK and the EU and the fact that elsewhere, such as NZ, foreign ownership is a trojan horse for imports as evidence for regionalisation.

EU Direct Investment in the UK has other adverse effects, for instance an EU car maker operating in UK may import 80% of parts from EU, paid in Euros, sell cars in the EU for Euros and the UK economy only see the wages paid to assembly workers as a benefit to the economy. This is a a very low benefit for an entire car factory, especially when it is considered that the failure to buy parts in the UK decreases UK manufacturing. EU FDI increases regionalisation with all the benefit of UK production being returned to Eurogroup companies.

We can suggest that it is incumbent on those who want a Single Market with the EU to prove that EU companies in the UK are not creating our trade deficit and turning the UK into a regional economy. (A regional economy eventually consists of agriculture, local services such as electricians and plumbers, retail, public services and a handful of major industries).

The fact that settled people voted Leave in the referendum was like a canary in a coal mine. They were the first to experience the effects of regionalisation of the whole UK. The mobile urban population including journalists and academics voted in their own interests in the referendum - after all, they had had to move from the regions of the UK to the cities in the UK's own version of regionalisation and were happy to abandon the whole country to that fate within the EU. However, on reflection journalists might sympathise with the settled population and reject the endless lobbying by Multinational Companies, Bankers and their economists to configure global economics in their favour. (See Globalisation - who benefits?).

Haven't heard about this data in the broadcast media? George Orwell, whilst at the BBC, was racked with guilt about suppressing news to advance the war with the Axis. Are modern journalists of so little integrity that they are using this weapon against their country to further their own agenda?

27/10/17

Comments