The problem is due to the Union itself because within a Union the National effort cannot be kept within the Nation.

The data shows that UK Trade is performing far better outside the EU than within it and constitutes grounds for an immediate re-examination of the UK-EU trading relationship. The data also shows that there is probably a systemic problem in UK-EU trade. Why is the UK-EU trade balance so bad?

Foreign direct investment alone now totals about £1000 billion in the UK (£1trn see Government Article below) and there have been large inward flows in portfolio investments etc. Is foreign investment in the UK excessive and how is this affecting the economy?

The UK has the peculiar status of having its own, major currency within the EU. This allows EU investors to hedge against the Eurozone crisis within the relatively safe, legal framework of the EU. As a result there has been a large inflow of foreign investment into the UK with about 50% coming from the EU and 50% from the rest of the world. As the investment flows into the economy, it provides a high availability of foreign exchange to purchase imports. This investment always creates liabilities for profits, interest, dividends and other payments (the Primary Income deficit) and in the case of EU investments this has created an annual bill of about £40 billion. The net result of excess imports and a Primary Income deficit is a chronic Balance of Payments Current Account deficit with the EU:

The annual Current

Account deficit with the EU is now routinely over £100 billion (5.8%

of GDP) and is responsible for nearly all of the UK Current Account

deficit. This deficit is “financed” by continuous, high flows

annually of foreign investment money: the UK is paying off a revenue deficit by

acquiring liabilities. The flow of foreign currency for investment

raises the value of sterling which has led to an increase in imports

from the EU and this has created the large deficit in the trade of

goods with the EU. The UK displays the typical profile of an

overvalued currency with the expected rise in imports and a fall in

exports:

The Current Position of UK- EU Trade

The Graph below

summarizes the current trading position with the EU:

The data shows that UK Trade is performing far better outside the EU than within it and constitutes grounds for an immediate re-examination of the UK-EU trading relationship. The data also shows that there is probably a systemic problem in UK-EU trade. Why is the UK-EU trade balance so bad?

The value of UK exports

to non-EU countries is now considerably in excess of the value of

exports to the EU:

However, exports to the

EU are only failing to grow, not declining massively. So what is

going wrong with UK-EU trade, why is there such a huge deficit? The

answer lies in a large growth in imports from the EU:

The reason for this

growth in imports is that, as a result of financial, non-trade

transactions, UK consumers have been provided with a large excess of

Euros to spend on EU goods. This will be discussed in the following

sections. The Office of National Statistics has described this use of overseas funds to buy imports:

"In every year since 1998, the UK has borrowed from abroad to finance its continuing current account deficit. This has resulted in inward investment (UK liabilities) exceeding outward investment (UK assets)." Pink Book 2014, Part 2

However, since the Eurozone crisis this should be reworded: "The UK has financed its current account deficit using the inward investment that it has received". This provides a more accurate summary of the same phenomenon and allows us to deal with it.

"In every year since 1998, the UK has borrowed from abroad to finance its continuing current account deficit. This has resulted in inward investment (UK liabilities) exceeding outward investment (UK assets)." Pink Book 2014, Part 2

However, since the Eurozone crisis this should be reworded: "The UK has financed its current account deficit using the inward investment that it has received". This provides a more accurate summary of the same phenomenon and allows us to deal with it.

The Consequences of Economic Union

If

the UK were part of a full economic union any benefit from trade

would rapidly percolate out of the UK into the rest of the union in

the same way as it percolates out of London to Surrey or from

Scotland to England. In an economic

union the effort of UK exporters will not necessarily enrich the UK

because it will be distributed into other parts of the union. The

UK is currently in a partial economic union with the EU and is

experiencing the first effects of distributing its national effort

elsewhere. The movement of money to the centre of a country is called "Regionalisation", the UK is becoming a region of the EU and this is being made obvious because the UK has a separate currency from the Euro (the EU national currency). This process could be beneficial to pan-European

enterprises but UK MPs and the UK Government must decide whether the

process is beneficial to the people that they represent.

Excess Foreign Investment and the Balance of Payments

Foreign investment in the UK is excessive when it greatly exceeds UK investment abroad and when the excess flow of foreign funds into the economy has a significant effect on the purchase of imports.Foreign direct investment alone now totals about £1000 billion in the UK (£1trn see Government Article below) and there have been large inward flows in portfolio investments etc. Is foreign investment in the UK excessive and how is this affecting the economy?

The UK has the peculiar status of having its own, major currency within the EU. This allows EU investors to hedge against the Eurozone crisis within the relatively safe, legal framework of the EU. As a result there has been a large inflow of foreign investment into the UK with about 50% coming from the EU and 50% from the rest of the world. As the investment flows into the economy, it provides a high availability of foreign exchange to purchase imports. This investment always creates liabilities for profits, interest, dividends and other payments (the Primary Income deficit) and in the case of EU investments this has created an annual bill of about £40 billion. The net result of excess imports and a Primary Income deficit is a chronic Balance of Payments Current Account deficit with the EU:

Calculations of the real value of the pound show that it has been very overvalued as a result of foreign investment. Foreign investment entails the exchange of billions of Euros etc. for pounds, creating a demand for pounds and hence increasing the value of the pound.

(Post referendum update: Fortunately the EU Referendum has finally adjusted the pound back to its correct, trading value, a change that started in 2014 as the Eurozone economies improved. The direct, trading value of the pound (PPP) with investment effects removed is given by the green line in the graph below:

As Euros flow into the UK the exchange rate for the pound increases whilst the underlying value of the pound (the value without an inflow of Euros) declines as the trade deficit widens. The economy appears rosy on the surface whilst it is rotting within. See Note 2 below.)

Not only has foreign investment elevated the pound, making imports cheap and UK exports expensive, the large inflow of imported goods and the management of foreign investment has distorted the UK economy, favouring services over the production of goods. This in turn has decreased the offering that the UK can make in the general international trade in goods. The growth in the relative importance of services is shown below:

(Post referendum update: Fortunately the EU Referendum has finally adjusted the pound back to its correct, trading value, a change that started in 2014 as the Eurozone economies improved. The direct, trading value of the pound (PPP) with investment effects removed is given by the green line in the graph below:

As Euros flow into the UK the exchange rate for the pound increases whilst the underlying value of the pound (the value without an inflow of Euros) declines as the trade deficit widens. The economy appears rosy on the surface whilst it is rotting within. See Note 2 below.)

Not only has foreign investment elevated the pound, making imports cheap and UK exports expensive, the large inflow of imported goods and the management of foreign investment has distorted the UK economy, favouring services over the production of goods. This in turn has decreased the offering that the UK can make in the general international trade in goods. The growth in the relative importance of services is shown below:

The EU Single Market is "Regionalizing" the UK. Does the UK really want to be a region of the EU specialising in Financial Services?

The net effect of the flow of excess foreign investment into the UK economy is largely negative. It distorts the balance of industry and services in the economy and favours imports rather than exports. This potential negative effect of foreign investment is well known in the economics literature and the UK is an example of the negative effects outlined by Jože Mencinger (2008) in his seminal paper on the effect of foreign investment on the current account balance in New Member States of the EU. Unlike the New Member States of the EU, the UK has no need of excess foreign investment (See Will Hutton's article http://www.theguardian.com/commentisfree/2015/mar/08/selling-off-britain-ownership-crisis-debate and also see Note 1 below

The net effect of the flow of excess foreign investment into the UK economy is largely negative. It distorts the balance of industry and services in the economy and favours imports rather than exports. This potential negative effect of foreign investment is well known in the economics literature and the UK is an example of the negative effects outlined by Jože Mencinger (2008) in his seminal paper on the effect of foreign investment on the current account balance in New Member States of the EU. Unlike the New Member States of the EU, the UK has no need of excess foreign investment (See Will Hutton's article http://www.theguardian.com/commentisfree/2015/mar/08/selling-off-britain-ownership-crisis-debate and also see Note 1 below

It is conventional to

blame UK exporters for the current account deficit but the deficit is

clearly due mainly to imports and has resulted from structural

problems related to the flow of money between the EU and UK. The net

result is that the UK is distributing its financial surplus to the EU

by purchasing goods. This huge import of EU goods undermines British companies in those areas of production, areas that are popular in the EU, and so probably damages the ability of UK producers to export to the EU.

Why are Euros flowing into the UK? It is because the UK has very different economic policies from the Eurozone. It is a better place for Eurozone companies to invest for growth. However, although this is good for Eurozone finances it is terrible for UK citizens because the investment employs imported Eurozone citizens and exports the profits. The UK gets the overcrowding and disruption and the Eurozone gets the benefit.

Why are Euros flowing into the UK? It is because the UK has very different economic policies from the Eurozone. It is a better place for Eurozone companies to invest for growth. However, although this is good for Eurozone finances it is terrible for UK citizens because the investment employs imported Eurozone citizens and exports the profits. The UK gets the overcrowding and disruption and the Eurozone gets the benefit.

The problem of excess

foreign investment is probably costing the UK economy about £50

billion to £60 billion per annum, this being the loss in industrial

volume due to the imbalance in trade (half the current trade deficit

with the EU) plus an estimate of the amount that could be recouped

from the global primary income deficit. The EU has a wide range of

directives concerning the management of a country's accounts that

ensure the free movement of money and restrict any action. This

means that the problem can only be tackled by leaving the EU and

copying and improving on the measures taken by independent countries

such as Switzerland which have had similar problems with excess

investment. This need to manage capital flows means that the UK must leave the Single Market and adopt a Free Trade Agreement with the EU like South Korea and many other countries. Any "Single Market" agreement would simply perpetuate the current problems, it would only be suggested as a re-entry into the EU by the back door. The objective should be, in the long run, to balance

the current and financial accounts independently whilst increasing

the volume of trade in the current account.

Note 1: The Benefit of Foreign Investment in the UK

Surely foreign

investment is beneficial? There is a great deal of confusion about

foreign investment that results from its effects in underdeveloped

countries versus its effects in developed countries.

When incomes are low

and unemployment high the provision of work and wages is a real bonus

and sending profits and dividends overseas to compensate foreign

investors is a small price to pay. However, when incomes are high

and unemployment is low the inward flow of excess foreign investment

provides a transient excess of foreign exchange that finances

imports, imbalancing the economy, and creating a long term liability

for payment to overseas investors of profits, dividends etc. This

liability means a commitment to the long term sharing of the wealth

of the UK economy with wealthy people overseas rather than focussing

it in the UK. Furthermore, if unemployment is low the foreign

investment creates a demand for labour from overseas. This all

benefits the industrialist, foreign shareholder and migrant worker

but not the individual UK citizen or the long term health of the

economy and country. The Government should be representing the long

term interests of the UK citizen rather than the interests of the

general population of the EU, industrialists and foreign

shareholders.

In the best case of

foreign investment in the UK, that used to create employment rather

than currency speculation etc., there are yet more problems. The

creation of 100,000 jobs in the UK, which has only 5% unemployment,

will simply pull in 50-100,000 workers from overseas. The net effect

for the wealth of the country as a whole is negative in the long run

because it creates a large primary income deficit, as detailed above,

and, of course, no change in income per head of population,

a large population growth and overpopulation. It is this illusory growth in

GDP, the growth that results from excess foreign investment in a

developed country, that constitutes much of the “gains” for Trade

and Industry described in reports that favour remaining in the EU.

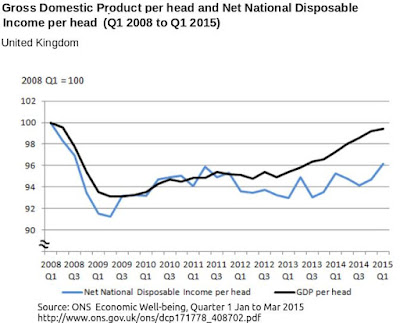

The extent to which the

GDP of the UK is being transferred overseas is clear when GDP is

compared with Net National Disposable Income, the proportion of the

Gross Domestic Product that is retained in the UK.

The upper line in the

above graph is the headline figure for GDP and the lower is the

actual value of this GDP for the citizens of the UK. The difference

between the curves is largely due to remittances abroad to foreign

investors. The graph above also shows that UK wages are being kept low by free movement of labour, it is amazing how corporate PR has managed to portray free movement of labour in the EU as a wonderful benefit for individuals when it is about low wages.

It is not generally realised that much of foreign investment in UK industry is investment by foreign, state owned enterprises. The ownership of property is equally suspect According to the Financial Times:

"At least £122bn of property in England and Wales is held through companies in offshore tax havens ...... Nearly two out of three of the 91,248 foreign-company owned properties in England and Wales are held via the British Virgin Islands and Channel Island structures."

So the British are paying profits and dividends to EU governments and rents to tax evaders. The wonders of foreign investment...

It is not generally realised that much of foreign investment in UK industry is investment by foreign, state owned enterprises. The ownership of property is equally suspect According to the Financial Times:

"At least £122bn of property in England and Wales is held through companies in offshore tax havens ...... Nearly two out of three of the 91,248 foreign-company owned properties in England and Wales are held via the British Virgin Islands and Channel Island structures."

So the British are paying profits and dividends to EU governments and rents to tax evaders. The wonders of foreign investment...

Nearly

two out of three of the 91,248 foreign-company owned properties in

England and Wales are held via the British Virgin Islands and Channel

Island structures. - See more at:

http://www.taxresearch.org.uk/Blog/2014/08/01/tax-haven-ownership-of-uk-property-might-cost-2-billion-year-in-tax-avoidance/#sthash.znFX95Gh.dpuf

Nearly

two out of three of the 91,248 foreign-company owned properties in

England and Wales are held via the British Virgin Islands and Channel

Island structures. - See more at:

http://www.taxresearch.org.uk/Blog/2014/08/01/tax-haven-ownership-of-uk-property-might-cost-2-billion-year-in-tax-avoidance/#sthash.znFX95Gh.dpuf

Nearly

two out of three of the 91,248 foreign-company owned properties in

England and Wales are held via the British Virgin Islands and Channel

Island structures. - See more at:

http://www.taxresearch.org.uk/Blog/2014/08/01/tax-haven-ownership-of-uk-property-might-cost-2-billion-year-in-tax-avoidance/#sthash.znFX95Gh.dpuf

The improvements in

Trade and Industry that would truly benefit the UK are gains in

productivity and hence higher pay for the existing population;

although these might seem to be difficult to achieve, perhaps

restrictions on migration rates to, say, 300,000 a year might have

the desired effect by limiting the availability of low cost labour,

but this is impossible within the EU.

Note 2:

Over the years the Bank of England has tried to lower the value of the pound. As a member of the EU the only major tool at its disposal was to increase the supply of sterling but this was insufficient to counteract the over-valuation of the pound due to foreign currency inflow because increasing money supply without increasing production has adverse effects on the economy.

Summary

Why the Balance of Payments and Trade are so bad and how this affects the UK is covered in detail above but here is a summary for those in a hurry:

The UK has a vibrant economy and an independent currency. The Eurozone economy is flat and the euro is under perpetual threats. EU Investors choose to invest in the UK because it is governed by EU rules and connects seamlessly to the EU economy. The UK is selling off its industry and property at a huge rate. This sale creates a liability for profits, dividends and rentals to be paid overseas on a huge scale. The largely state owned companies that invest in the UK buy British companies and pay corporation tax in their home country. They use many suppliers from their own countries and hence cause an increase in imports. Their business investments also pull in large numbers of EU workers to keep wage rates down and because the UK has low unemployment. The UK is unable to stop the large haemorrhaging of funds to the EU because of controls on the movement of money, it cannot stop the flow of workers because of free movement of labour and cannot affect the preferential purchase of imports from the EU because of free trade. The EU investor can take away their profits to the EU without hindrance and without making significant investments that benefit UK citizens. The EU investor can even sell up and take away their original investment or relocate it without difficulty. Any increase in GDP due to EU investment is exported to the EU and does not benefit the UK - this is what the "current account deficit" actually means.

The net effect is that the UK is allowing EU companies to operate enclaves in the UK that are owned by, and benefit, the Eurozone but which use the UK economic environment to prosper. The only answer is to leave the EU, especially the Single Market which allows the flows of capital and labour that cause the damage.

Note 2:

Over the years the Bank of England has tried to lower the value of the pound. As a member of the EU the only major tool at its disposal was to increase the supply of sterling but this was insufficient to counteract the over-valuation of the pound due to foreign currency inflow because increasing money supply without increasing production has adverse effects on the economy.

Summary

Why the Balance of Payments and Trade are so bad and how this affects the UK is covered in detail above but here is a summary for those in a hurry:

The UK has a vibrant economy and an independent currency. The Eurozone economy is flat and the euro is under perpetual threats. EU Investors choose to invest in the UK because it is governed by EU rules and connects seamlessly to the EU economy. The UK is selling off its industry and property at a huge rate. This sale creates a liability for profits, dividends and rentals to be paid overseas on a huge scale. The largely state owned companies that invest in the UK buy British companies and pay corporation tax in their home country. They use many suppliers from their own countries and hence cause an increase in imports. Their business investments also pull in large numbers of EU workers to keep wage rates down and because the UK has low unemployment. The UK is unable to stop the large haemorrhaging of funds to the EU because of controls on the movement of money, it cannot stop the flow of workers because of free movement of labour and cannot affect the preferential purchase of imports from the EU because of free trade. The EU investor can take away their profits to the EU without hindrance and without making significant investments that benefit UK citizens. The EU investor can even sell up and take away their original investment or relocate it without difficulty. Any increase in GDP due to EU investment is exported to the EU and does not benefit the UK - this is what the "current account deficit" actually means.

The net effect is that the UK is allowing EU companies to operate enclaves in the UK that are owned by, and benefit, the Eurozone but which use the UK economic environment to prosper. The only answer is to leave the EU, especially the Single Market which allows the flows of capital and labour that cause the damage.

Other Structural Problems

There are also lesser

factors that affect UK-EU trade. Perhaps the most important of these

is the way the Eurozone was created in the Maastricht Treaty. Norman

Lamont has described the problem:

"At Maastricht,

one of the Germans’ main objectives was to secure a “no bail-out”

clause to joining a single currency, because they were worried about

the large indebtedness of Italy. But the logic of currency union is

that the strong countries should assist the weaker ones."

This means that the

Northern European countries in the Eurozone can use a currency, the

Euro, that has a lower exchange rate than might be expected from

their economic performance. These countries can take the benefit of

this rate without paying the social costs in Southern Europe. Any

future Free Trade Agreement with the EU would need to address this

obvious inequity. The UK should not be a party to such exploitation.

See:

Lamont.

Daily Telegraph

http://www.telegraph.co.uk/finance/financialcrisis/8771090/Norman-Lamont-Its-not-just-the-euro-its-the-European-Union-that-needs-rethinking.html

Growth

The EU has been a

region of low growth for the past decade. Almost all assessments of

the benefit of the EU for UK Trade and Industry either assume that

the EU will return to growth or that the UK will grow at the same

rate as is currently the case within the EU after leaving.

Independent assessments of the growth potential of the EU such as

that of the IMF, disagree that the EU will return to growth:

|

| Growth of EU GDP % |

(The latest IMF estimates for Eurozone growth are even more pessimistic – see https://www.imf.org/external/pubs/ft/weo/2015/01/weodata/index.aspx ).

Furthermore, on leaving

the EU the UK economy would be expected to grow more strongly if

managed as well as many other independent, developed economies.

Tariffs

When the UK acceded to

the EEC in 1973 it joined a customs union. The objective was to

remove the tariffs on trade. Tariffs in the 1970s were frequently

over 10% on a wide range of goods. In recent years there has been a

considerable, global, reduction in tariffs due to the work of the WTO

and there have been bilateral agreements between the EU and much of

the rest of the world. The Free Trade Agreement (FTA) between the EU

and Canada and the FTA between the EU and South Korea remove almost

all tariffs. A similar FTA is about to be signed between the EU and

Japan. The UK pays over £11 billion a year to avoid EU tariffs.

Canada etc. pay nothing. The saving consequent on leaving the EU

will be at least £11 billion per annum when other factors such as rebalancing the economy are taken into account, this is a huge subscription for enjoying Free Trade with the EU.

It should be noted that

if the UK remains in the EU the forthcoming FTA between the EU and

Japan will leave UK manufacturers of Japanese cars without a tariff

advantage.

Complex areas of trade,

such as the trade in Wines and Spirits, can also be the subject of

FTAs. As an example, the agreement between the EU and Canada on

wines and spirits protects Geographical Indications etc. as well as

removing tariffs. This means that areas of trade such as the Scotch

Whisky industry can continue to trade with the EU without extra cost.

That the EU would not

urgently seek an FTA with the UK if the UK were to leave the EU is

unimaginable given that the UK takes £225 billion of EU goods

imports per annum and exports only £140 billion in return (See

Table 2 in ONS “UK Trade 2015”

http://www.ons.gov.uk/ons/dcp171778_413031.pdf

). However, the total cost of tariffs on exports to the EU and the

world, even if the UK had no bilateral agreements, has been

calculated at only £7.4 billion (“Change or Go” - see below)

which is about £4 billion less than the amount paid to the EU avoid

tariffs.

Although tariffs are now small it would suit the UK to have a period of tariffs against EU goods so that UK exporters can recover. It is permissible under WTO rules to refund tariffs paid by UK exporters when exporting to the EU (the refund could be financed by import tariffs on EU goods), this may provide the advantage needed for recovery.

Although tariffs are now small it would suit the UK to have a period of tariffs against EU goods so that UK exporters can recover. It is permissible under WTO rules to refund tariffs paid by UK exporters when exporting to the EU (the refund could be financed by import tariffs on EU goods), this may provide the advantage needed for recovery.

See also:

The EU-South Korea

Free Trade Agreement

http://trade.ec.europa.eu/doclib/docs/2011/october/tradoc_148303.pdf

The EU-Canada

Comprehensive Economic and Trade Agreement

http://ec.europa.eu/trade/policy/in-focus/ceta/

The Agreement between

the EU and Canada on Trade in Wines and Spirits

http://ec.europa.eu/world/agreements/SummartOfTreatyAction.do?step=0&treatyId=292

Jože Mencinger (2008).

THE "ADDICTION" WITH FDI AND CURRENT ACCOUNT BALANCE.

INTERNATIONAL CENTRE FOR ECONOMIC RESEARCH WORKING PAPER SERIES.

Working Paper No.16/2008.

http://servizi.sme.unito.it/icer_repec/RePEc/icr/wp2008/ICERwp16-08.pdf

Liquidity swap agreements

First published 9/12/15

Also See:

“The Swiss Trade

Surplus Unveiled” by George Dorgan (2012)

http://snbchf.com/swiss-macro/2012-sm/swiss-trade-surplus-balance/

).

Government Article.

“UK wins a record number of investment projects and maintains

position as top investment destination in Europe”

https://www.gov.uk/government/news/uk-wins-a-record-number-of-investment-projects-and-maintains-position-as-top-investment-destination-in-europe

- although the Swiss are tearing their hair out about excess

Eurozone investment the UK government seems to be unaware of the

problem.

Liquidity swap agreements

First published 9/12/15

Comments

The first sentence "The data shows that UK Trade is performing far better outside the EU than within it" is a classic: It can easily be rewritten in the sense that 'despite EU membership'or even "because of membership of the EU" non-EU trade is doing rather well. Those two variants would be just as true depending whether one views the EU glass half full or half empty.

Then John tries to convince the casual reader that somehow those evil Europeans are putting Euros in the pockets of unsuspecting Brits, who instead of changing them straigt into sterling feel obliged to spend them on EU manufactured goods or save them up for their summer holidays on the continent.

I have written about the UK trade deficit extensively in my own blog IdentiySpace and unsurprising my conclusions are diametrically opposed to John's. I actually do blame UK exporters for not pulling their socks up, for not diving into the enormous opportunities of being part of the greatest single market right on the UK's doorstep.

What I observe is UK eBayers not being arsed to change their delivery preferences from 'deliver to UK and Eire only' to 'will deliver anywhere in the EU, let alone globally e.g. to their precious Commonwealth brethren. So much for trading globally. And its not just eBayers, its also big successful DIY chains, major UK mail order companies. Being a UK ex-pat living in France I know this from experience. Even paying in sterling with my Barclaycard and sourcing my own transport companies they won't take an order from a frog.

And John thinks this is because the UK is being spoiled by Direct Foreign Investments. Well I call that 'selling the UK family silver' It is time UK traders got off their lazy arses and started selling abroad rather than buying, which is the easy bit in international trade.

If I look at EU neighbour The Netherlands, this country earns almost 30% of its income from the export of goods and services. In 2012, the value of exports was 86.7% of the Netherlands’ GDP. The comparable figure for exports of goods and services (% of GDP) in the United Kingdom peaked at 32% in 2011, according to the World Bank.

Could the truth be far more inconvenient? Could it be that maybe, just maybe, Britain isn’t such a great trading nation in the first place? No wonder the UK government now pays for TV adds to persuade UK SMEs to start exporting. You see dreaming of the UK being this great trading nation is one thing, going out there and actually doing it quite another.

And as they say learn to walk (selling in the EU common market) before thinking you can start running (after brexit)

The truth is consecutive Tory governments have favoured financial services for their chums in the City of London to the detriment of labour voting workers in Britain's northern industrial heartlands. Personally I would have favoured the UK economy to have two legs to stand on: Industry and Services. #brexit is not going to miraculously revive UK manufacturing and the UK export of goods as John suggests, rather it risks killing the goose that lays its only golden eggs. You guessed it the one that lives in the City of London.

https://identityspace.wordpress.com/2016/02/09/dr-ruth-lea-econ-barks-up-the-wrong-tree-again-and-again-and-again-x12/

Helpfully (or maybe the opposite) to stimulate an informed #brexit debate ONS now occasionally treats us to these EU vs. Non-EU statistics that John has faithfully reproduced in this blog. One bar chart graph John selectively choose to ignore can be found on page 12 of the ONS 'Economic review for 2015'. It shows a further breakdown of what Eurosceptics are so proud of: Their positive non-EU trade balance. First of all it needs clarifying that non-EU trade in goods was also deep in the red in 2015, in fact 36 billion pound in the red. Only when you add 'services' this non-EU trade just tips the balance from red to green. But if you look at the breakdown we see that China trade is in the red, India trade is in the red, Norway trade is in the red. What stands out is the enormous surplus generated by the trade with the USA. The other surplus countries are not broken down in the graph, but I believe Saudi Arabia makes up the bulk of that lot.

Call me a Europhile, call me a cynic but it seems to me this 'Global trade golden future' fervent Eurosceptics like to sell the unsuspecting voter boils down to nothing but 'arms for oil' trade fomenting more wars and strife in the Middle east where all these refugees flooding Europe scramble away from.