We have all read how Foreign and EU companies have been buying up UK companies (See Selling off Britain is not a sign of strength.. and Independent Article). How much does this cost the UK? What does it cost you and me?

Foreign owned UK companies accounted for 50% of all UK business turnover in 2014 of which EU owned UK companies (£686bn turnover) accounted for 25% of UK business turnover.

About 50% of all larger UK Manufacturing Companies are foreign owned:

As a member of the EU the UK implements the EU rules for foreign businesses which specify that foreign, non-EU owned companies must use a minimum percentage of locally sourced parts and stock in their production. In the case of Korea this percentage is 55% local parts, for Japan it was 80% local parts. This is the standard set of conditions under which Foreign Direct Investment (FDI) works globally and is the basis on which all those panegyrics about the advantages of FDI are written. (See Note 2 on the definition of FDI).

In contrast to non-EU companies, EU companies that own UK business are not subject to any meaningful regulation about the sourcing of parts, labour or capital transfers. In principle an EU company can acquire a UK company and turn its factories into warehouses for the distribution of EU made goods whilst employing low cost Eastern European staff. None of the assumptions about the benefits of FDI apply to EU acquisitions of UK companies.

Now that at least 25% of all UK business turnover is in the hands of EU owned UK businesses we can see the effect. These UK companies act like an open door for imports from the EU within the customs union and Single Market.

The problem for the British commercial consumer is that if they acquire clay from English China Clays (French), Oxy-acetylene from the British Oxygen Company (German), travel home on Thameslink (part French), drive to Heathrow (Spanish) in their Vauxhall (French) and phone home using O2 (Spanish) they will find that all of these "UK" brands are foreign, EU owned.

Paradoxically you would be buying more British goods if you bought a UK manufactured Japanese Honda - 60% British (see Note 1) - than a "UK" manufactured Vauxhall Astra - 25% British. Vauxhall is owned by Groupe PSA, a French company which does not observe the local parts percentage imposed on Honda.

If this difference between non-EU and EU based foreign ownership were significant we should see a large difference in trade balance between non-EU and EU markets:

The EU is able to export huge quantities of goods to the UK as a result of owning UK companies. Any UK company that grows large enough to compete is simply bought out. This huge, c£70-80bn a year Trade Deficit with the EU reduces UK GDP by 4% a year and makes all of us poorer and causes Austerity. If you are unaware of "sectoral balances" see huge Trade Deficits cause Austerity. and if you had not heard that Trade Deficits reduce GDP see The expenditure basis of calculating GDP.

The damage is not just in trade. The profits made by UK companies with EU owners can be simply transferred to the EU parent company.

According to the Office of National Statistics the EU had £541,000,000,000 (£541bn) invested in UK companies at the end of 2016 and these yielded £59bn in intercompany transfers to the parent company. £20bn of this amount was paid in dividends to the EU parent. Thanks to the free movement of capital in the Single Market and intercompany accounting this money can be transferred in Euros and never find its way into the UK economy. This impoverishes all of us in the UK because it deprives our economy of Head Office functions as well as the circulation of money (See Note 3).

The total Current Acount Deficit with the EU, which includes profits paid abroad and the trade deficit, is enormous at c.£115bn a year:

The crucial question is whether foreign owned UK companies are responsible for the trade deficit. The simple answer is YES:

The solution to the Trade Deficit with the EU is to insist that EU owned UK companies obey the same rules for local products and parts as, say, Japanese or US owned companies obey. Obviously Brexit is essential to implement this solution.

So why is the UK Government selling our economy? The problem lies in an ideological belief in FDI. Initially FDI looked good, when it was being performed by US, Japanese or Korean companies. These companies were forced to use local sourcing of components and labour and found transfers of capital back to the parent to be problematical so re-invested in the UK. The government, especially Philip Hammond, then touted for FDI and found a huge uptake from German, French and other EU countries. It didn't occur to them that EU investment in UK industry is entirely different from foreign investment in general. As a result of the growth of EU ownership the Tories needed to raise capital to plug the huge Trade Deficit that was appearing and, yes, you guessed it, the most available source of capital was more Foreign Direct Investment from the EU. It didn't matter to the Tories because they thought they would lose the 2015 election so Labour would have to sort out the mess!

The Tories are still blaming the Financial Crisis of 10 years ago for Austerity when it is now clearly due to the Trade and Current Account Deficits with the EU which are costing as much as the bank bailouts.

The huge penetration of the UK economy by foreign enterprises has other problems. If you are an MP and are lobbied by English China Clays or British Oxygen you may believe that you are dealing with bona fide British interests, not Eurozone interests. Similarly, if the CBI is making an announcement for "British" industry it must be remembered that the CBI has numerous foreign members. The CBI's "What our members say" section has this entry praising the CBI by Veolia (French): "Aside from the access to ministers and political insider information, another key benefit of CBI membership is the opportunity to network with other likeminded industrial contacts and hear different business opinions." Lobbying by "British Industry" is not necessarily in the interests of British Industry any more.

Other EU Countries

In France foreign owned companies generate 25% of manufacturing turnover and 30% of manufacturing exports (see International Development of French Economy p13) whereas foreign owned companies in the UK generate c.50% of turnover and only 15% of exports.

It is clear that EU companies in particular see the UK as a destination for their exports and not as a place to produce goods for export. The principal reason for this difference is that the UK uses Sterling and is not a member of the Eurozone. This means that goods produced in the UK attract foreign exchange charges and risks on any profit returned to the parent company so the obvious commercial choice for any EU parent company is to produce goods in the EU rather than the UK and to use a UK subsidiary to sell them in the UK.

The only other country that is in the EU but isolated from the Eurozone is Denmark in which foreign companies only produce 25% of GDP. A report by AmCham Denmark suggests that Denmark is too expensive and the government is obstructive to foreign investment. Denmark has neither a long term trade surplus nor deficit with the EU.

Some Foreign Owned UK Companies

Abbey National, Alliance & Leicester, Arriva, Associated British Ports, Amersham, Asda, BAA, Bentley cars, Bradford & Bingley, British Oxygen Company, British Plaster Board, British Steel/Corus, British Energy, Cadbury’s,

Foreign owned UK companies accounted for 50% of all UK business turnover in 2014 of which EU owned UK companies (£686bn turnover) accounted for 25% of UK business turnover.

About 50% of all larger UK Manufacturing Companies are foreign owned:

|

In contrast to non-EU companies, EU companies that own UK business are not subject to any meaningful regulation about the sourcing of parts, labour or capital transfers. In principle an EU company can acquire a UK company and turn its factories into warehouses for the distribution of EU made goods whilst employing low cost Eastern European staff. None of the assumptions about the benefits of FDI apply to EU acquisitions of UK companies.

Now that at least 25% of all UK business turnover is in the hands of EU owned UK businesses we can see the effect. These UK companies act like an open door for imports from the EU within the customs union and Single Market.

The problem for the British commercial consumer is that if they acquire clay from English China Clays (French), Oxy-acetylene from the British Oxygen Company (German), travel home on Thameslink (part French), drive to Heathrow (Spanish) in their Vauxhall (French) and phone home using O2 (Spanish) they will find that all of these "UK" brands are foreign, EU owned.

Paradoxically you would be buying more British goods if you bought a UK manufactured Japanese Honda - 60% British (see Note 1) - than a "UK" manufactured Vauxhall Astra - 25% British. Vauxhall is owned by Groupe PSA, a French company which does not observe the local parts percentage imposed on Honda.

If this difference between non-EU and EU based foreign ownership were significant we should see a large difference in trade balance between non-EU and EU markets:

|

| Balance of Trade in Goods and Services EU 28, Balance of Trade in Goods and Services NON-EU 28 |

The damage is not just in trade. The profits made by UK companies with EU owners can be simply transferred to the EU parent company.

According to the Office of National Statistics the EU had £541,000,000,000 (£541bn) invested in UK companies at the end of 2016 and these yielded £59bn in intercompany transfers to the parent company. £20bn of this amount was paid in dividends to the EU parent. Thanks to the free movement of capital in the Single Market and intercompany accounting this money can be transferred in Euros and never find its way into the UK economy. This impoverishes all of us in the UK because it deprives our economy of Head Office functions as well as the circulation of money (See Note 3).

The total Current Acount Deficit with the EU, which includes profits paid abroad and the trade deficit, is enormous at c.£115bn a year:

|

| See deficits in trade and investment income with the EU |

|

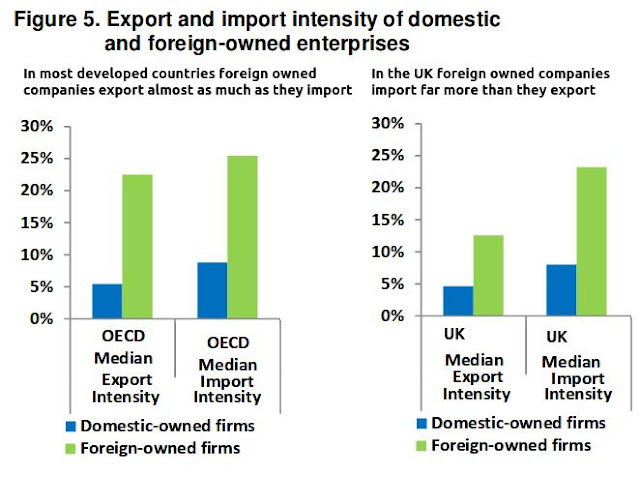

| Notice that foreign owned UK companies import much more than they export. http://www.oecd.org/investment/UNITED-KINGDOM-trade-investment-statistical-country-note.pdf |

So why is the UK Government selling our economy? The problem lies in an ideological belief in FDI. Initially FDI looked good, when it was being performed by US, Japanese or Korean companies. These companies were forced to use local sourcing of components and labour and found transfers of capital back to the parent to be problematical so re-invested in the UK. The government, especially Philip Hammond, then touted for FDI and found a huge uptake from German, French and other EU countries. It didn't occur to them that EU investment in UK industry is entirely different from foreign investment in general. As a result of the growth of EU ownership the Tories needed to raise capital to plug the huge Trade Deficit that was appearing and, yes, you guessed it, the most available source of capital was more Foreign Direct Investment from the EU. It didn't matter to the Tories because they thought they would lose the 2015 election so Labour would have to sort out the mess!

The Tories are still blaming the Financial Crisis of 10 years ago for Austerity when it is now clearly due to the Trade and Current Account Deficits with the EU which are costing as much as the bank bailouts.

The huge penetration of the UK economy by foreign enterprises has other problems. If you are an MP and are lobbied by English China Clays or British Oxygen you may believe that you are dealing with bona fide British interests, not Eurozone interests. Similarly, if the CBI is making an announcement for "British" industry it must be remembered that the CBI has numerous foreign members. The CBI's "What our members say" section has this entry praising the CBI by Veolia (French): "Aside from the access to ministers and political insider information, another key benefit of CBI membership is the opportunity to network with other likeminded industrial contacts and hear different business opinions." Lobbying by "British Industry" is not necessarily in the interests of British Industry any more.

Other EU Countries

In France foreign owned companies generate 25% of manufacturing turnover and 30% of manufacturing exports (see International Development of French Economy p13) whereas foreign owned companies in the UK generate c.50% of turnover and only 15% of exports.

It is clear that EU companies in particular see the UK as a destination for their exports and not as a place to produce goods for export. The principal reason for this difference is that the UK uses Sterling and is not a member of the Eurozone. This means that goods produced in the UK attract foreign exchange charges and risks on any profit returned to the parent company so the obvious commercial choice for any EU parent company is to produce goods in the EU rather than the UK and to use a UK subsidiary to sell them in the UK.

The only other country that is in the EU but isolated from the Eurozone is Denmark in which foreign companies only produce 25% of GDP. A report by AmCham Denmark suggests that Denmark is too expensive and the government is obstructive to foreign investment. Denmark has neither a long term trade surplus nor deficit with the EU.

Some Foreign Owned UK Companies

Abbey National, Alliance & Leicester, Arriva, Associated British Ports, Amersham, Asda, BAA, Bentley cars, Bradford & Bingley, British Oxygen Company, British Plaster Board, British Steel/Corus, British Energy, Cadbury’s,

Chloride, Eastern Electricity, English China Clays, Exel, Gatwick Airport, Guardian Royal Exchange, Hanson, Heathrow Airport, House of Fraser, Imperial Chemical Industries, Npower, Kleinwort Benson, Land Rover, Lasmo, London Electricity, Lucas

Industries, MG Rover, Midlands Electricity, Morgan Grenfell, O2/Cellnet, Orange, P & Ports, P & O Princess Cruises, Pilkington, Plessey/Marconi, PowerGen, Racal, Redland, Ready Mixed Concrete, Rolls Royce Cars, Rowntree’s, Saatchi & Saatchi, Scottish & Newcastle, Scottish Power, SSE, Smiths Aerospace, South East Water, Southern Water, Sun Life, Thames Water, Tomkins, Trafalgar House/Cunard, United Biscuits, and Warburg SG.

There are also numerous everyday names that are fronts for foreign companies:

EDF, EON, Greater Anglia, Northern Rail, Scotrail, Merseyrail, Docklands Light Railway, Gatwick Express, London Midland, Southern Rail, South Eastern Rail, Thameslink, Gt Northern, TransPennine

Notes

1. Japanese Inward Investment in UK Car Manufacturing

By Young-Chan Kim

2. FDI is used interchangeably with Foreign Investment in the industry of a country but this is not an exact correspondence, for instance foreign owned companies in the Netherlands produce only 36% of GDP but the Netherlands has a huge FDI figure as a result of its tax avoidance schemes. Ditto Luxembourg.

3. The penetration of UK industry is so extensive that it would be difficult to get reliable figures for how this investment affects say, R&D, or other head office functions. In the case of manufacturing a direct comparison of R&D spend by UK owned and foreign owned UK companies would now be a comparison of small versus large companies.

10/5/2018

There are also numerous everyday names that are fronts for foreign companies:

EDF, EON, Greater Anglia, Northern Rail, Scotrail, Merseyrail, Docklands Light Railway, Gatwick Express, London Midland, Southern Rail, South Eastern Rail, Thameslink, Gt Northern, TransPennine

Notes

1. Japanese Inward Investment in UK Car Manufacturing

By Young-Chan Kim

2. FDI is used interchangeably with Foreign Investment in the industry of a country but this is not an exact correspondence, for instance foreign owned companies in the Netherlands produce only 36% of GDP but the Netherlands has a huge FDI figure as a result of its tax avoidance schemes. Ditto Luxembourg.

3. The penetration of UK industry is so extensive that it would be difficult to get reliable figures for how this investment affects say, R&D, or other head office functions. In the case of manufacturing a direct comparison of R&D spend by UK owned and foreign owned UK companies would now be a comparison of small versus large companies.

10/5/2018

Comments